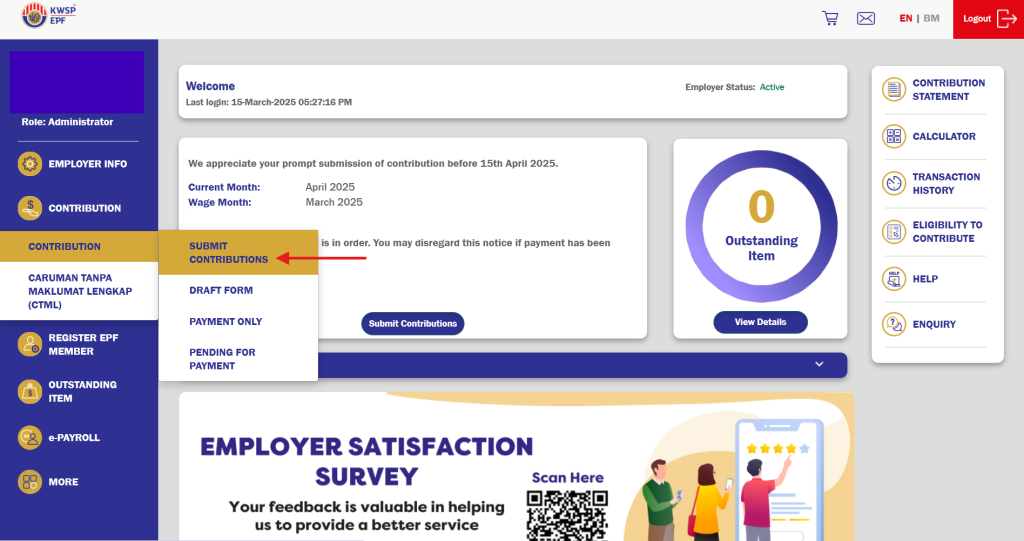

Step 1:

Once logged in, go to the top menu and click:

Contribution → Submit Contribution.

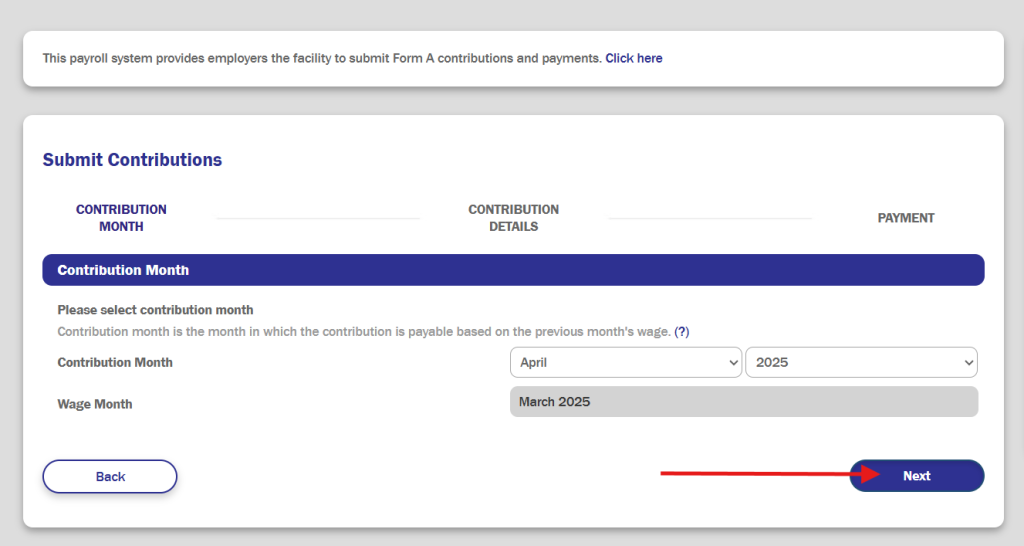

Step 2:

You will need to select the correct contribution month.

IMPORTANT: Contribution month is always one month after salary month For example, April 2025 payroll corresponds to the May 2025 contribution.

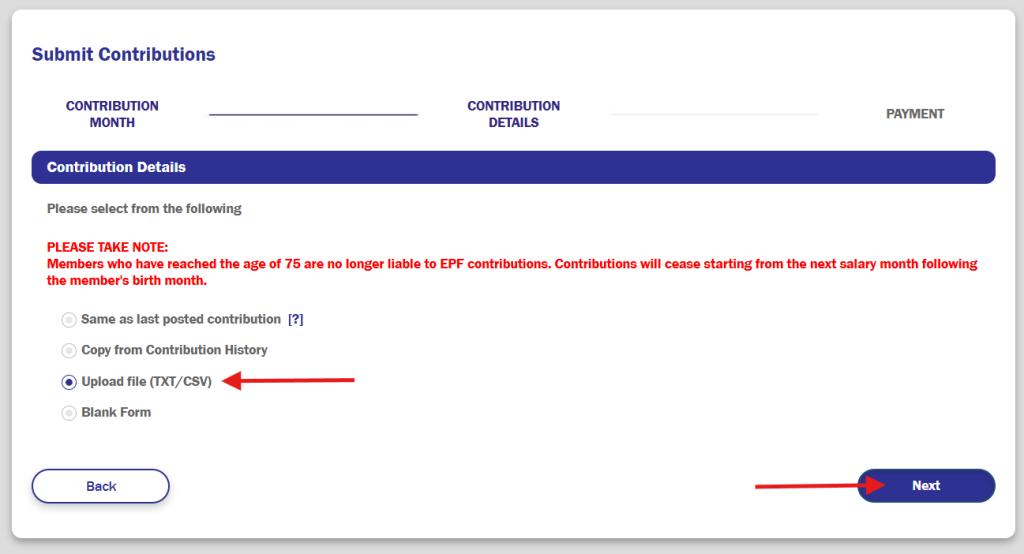

Step 3:

Then select “Upload file (TXT/CSV)” and upload the KWSP TXT file to the system.

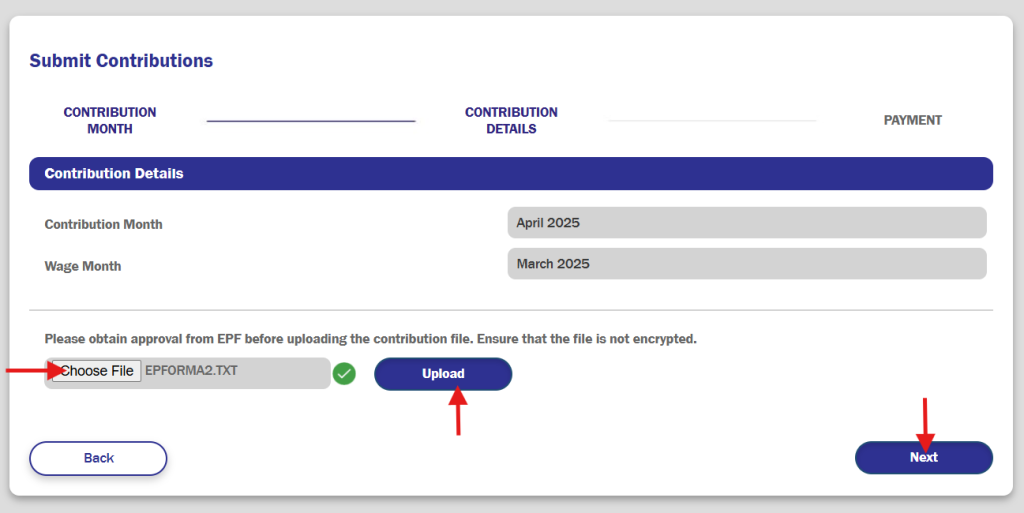

Step 4:

Choose your file and once the file is uploaded, click “Upload”, and then “Next”.

Step 5:

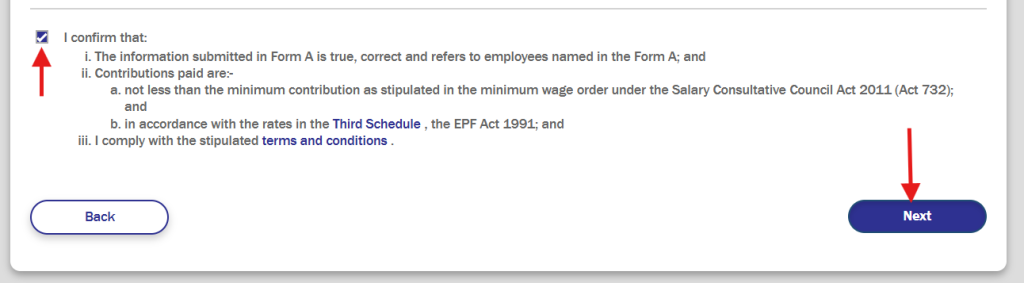

A list of employees along with their respective contributions will be displayed. Scroll down to the bottom of the page, tick “I confirm that:”, and then click “Next”.

Step 6:

Proceed with the payment.

1. What is a KWSP TXT file?

A KWSP TXT file is a structured text document that contains employee contribution details. It’s used to simplify monthly KWSP submissions by uploading it directly through the i-Akaun (Employer)

2. How do I generate the KWSP TXT file from SQL Payroll?

You can generate the required KWSP TXT file directly from SQL Payroll. For a step-by-step guide, please refer to the official documentation here:

👉 How to generate KWSP TXT file from SQL Payroll.

3. What is the correct format for the CSV file?

The file must follow KWSP’s required format, including columns such as: EPF Number, Name, IC Number, Wages, Employer Share, and Employee Share — without extra commas or empty rows.

The BEST Accounting Software in Malaysia